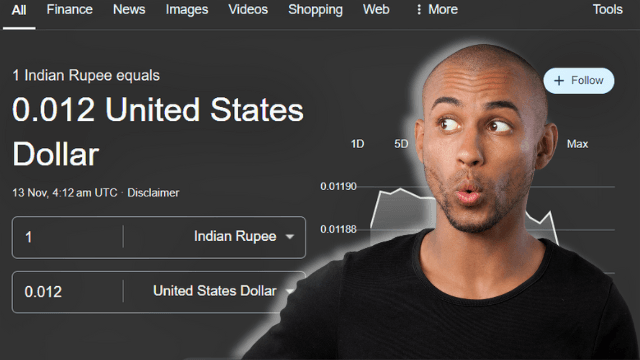

India ka IT sector, jo global market pe apna unique presence banaye hue hai, rupee vs dollar ke exchange rate mein hone wale fluctuations se kaafi impact hota hai. Khaaskar, jab rupee ki value dollar ke comparison mein kam hoti hai, toh iska seedha asar IT stocks pe hota hai. Aaj hum yeh dekhenge ki “Rupee vs Dollar” ka aaj ka asar IT stocks pe kaisa hai aur yeh long term me kis tarah ke opportunities ya challenges create kar sakta hai.

Rupee vs Dollar Rate Ka Seedha Asar IT Companies Par

Indian IT companies jaise ki Infosys, TCS, aur Wipro ka major revenue export markets se aata hai, khaaskar US se. Jab dollar ki value rupee ke muqable badhti hai, toh in companies ke revenue aur profits mein increment hota hai, kyunki foreign clients se unhe jyada paisa milta hai. Aaj ke rupee vs dollar rate ke fluctuations ne investors ko cautious bana diya hai aur kai log aaj hi ke din ka profit booking kar rahe hain.

Aaj Ka Rupee vs Dollar Exchange Rate Aur IT Stocks

Aaj agar rupee thoda kamzor hota hai, toh IT sector ke investors aur stakeholders ke liye ek achha signal ho sakta hai. Weak rupee, IT sector ke profits ko bada sakta hai kyunki exports se milne wali earning badh jaati hai. Lekin, agar rupee dollar ke muqable strong ho, toh yeh IT companies ke profits ko thoda impact kar sakta hai aur stocks mein decline dekhne ko mil sakta hai.

Investors ko samajhna hoga ki aise fluctuations short-term gains ke liye zaroor opportunities create karte hain, lekin long term mein overall sector pe focus karna zaroori hai.

Aaj Ki Market Trends Aur Kya Karein IT Stocks Ke Liye

Aaj ke din, agar rupee vs dollar ke comparison mein kam hai, toh long-term investors ko hold karna chahiye kyunki IT sector ka future export earnings par dependent hai. Waise, agar dollar mein aur strength dekhne ko mile toh aur bhi growth opportunities aa sakti hain. Yeh samay un logon ke liye sahi hai jo swing trading karte hain ya jo short-term profits banana chahte hain.

Future Implications Aur IT Stocks Ki Investment Strategy

Rupee aur dollar ke beech ke rate fluctuation ka impact IT stocks pe depend karta hai aur har investor ko apne portfolio diversification aur risk tolerance ke hisaab se investment karna chahiye. Long-term ke liye yeh sector ab bhi kaafi promising hai, par short-term investors ko market fluctuations ko samajhne ki zaroorat hai.

Conclusion

Aaj ka “Rupee vs Dollar” fluctuation IT stocks ke investors ke liye ek key factor hai. Dollar ki strength aur rupee ki weakness IT companies ke profits ke liye positive signal hai, par har fluctuation ko investment ke decision ke liye solely rely nahi karna chahiye. Investors ko detailed research aur market understanding ke sath aage badhna chahiye.

Merko nahi smjhaya