Introduction: APP Formula for Investment Success

Mid-Cap Stocks, Share market me invest karna ek art hai, aur agar aap APP formula – Analysis, Patience, and Profit ko follow karte hain, to aap apne investment ko safe aur profitable bana sakte hain. Pehla step hai Analysis, jisme aapko stocks ka market performance aur growth potential samajhna hota hai. Dusra step hai Patience, kyunki stock market volatile hoti hai, aur aapko sahi time ka intezaar karna padta hai. Aur teesra step hai Profit, jo aapko sabar ke baad milta hai. Aaj hum mid-cap vs large-cap stocks ka comparison karenge aur jaanenge aaj ke share market me kaun jeeta.

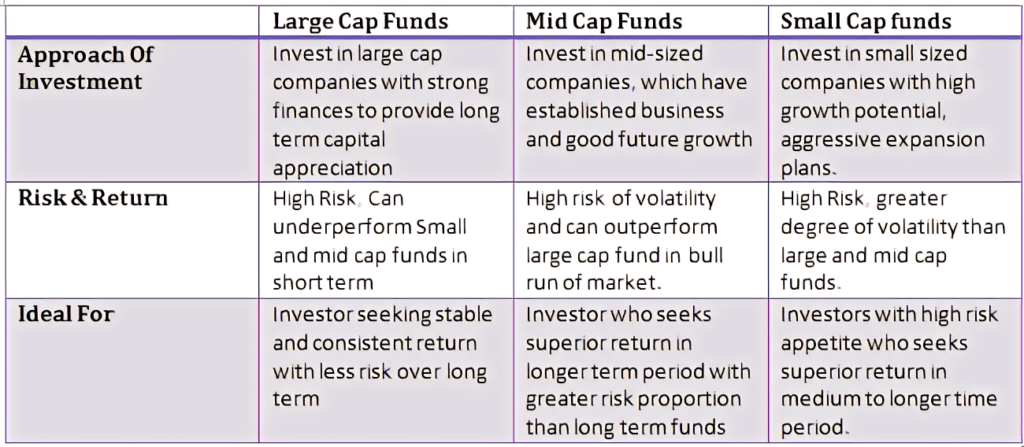

1. Mid-Cap Stocks Kya Hain?

Mid-cap stocks un companies ke hote hain jinki market capitalization generally $2 billion se $10 billion ke beech hoti hai. Yeh companies growth phase me hoti hain aur inme high potential hota hai, lekin risk bhi zyada hota hai.

Features of Mid-Cap Stocks:

- Growth Potential: Mid-cap companies fast grow kar rahi hoti hain. Inka target apna market share badhana hota hai, jo investors ke liye attractive hota hai.

- High Volatility: In stocks ki prices zyada fluctuate karti hain, isliye inme risk bhi zyada hota hai. Short-term ke liye yeh risky ho sakte hain, lekin long-term investors ke liye potential zyada hota hai.

Fayde:

- High Returns: Agar aap sahi company chun lete hain, to aapko long-term me substantial returns mil sakte hain.

- Undervalued Opportunities: Kai mid-cap companies undervalued hoti hain, jisse inme invest karke aap achha profit kama sakte hain.

Risks:

- Volatility: High risk ke saath volatility hoti hai, jisse prices ek din me kaafi upar ya niche ho sakti hain.

- Liquidity Issues: Mid-cap stocks ka trading volume relatively low hota hai, jo liquidity issues create kar sakta hai.

2. Large-Cap Stocks Kya Hain?

Large-cap stocks un companies ke hote hain jinki market capitalization $10 billion se zyada hoti hai. Yeh companies market me establish hoti hain, inka business stable hota hai, aur inme risk kam hota hai.

Features of Large-Cap Stocks:

- Stability: Large-cap stocks kaafi stable hote hain, kyunki yeh well-established companies ke hote hain jinke paas market share hota hai.

- Regular Dividends: In companies ka performance consistent hota hai, aur investors ko regular dividends milte hain.

Fayde:

- Lower Risk: Large-cap stocks relatively low risk hote hain, jo conservative investors ke liye best option hai.

- Market Leadership: Yeh companies apne sector me market leaders hoti hain, jo inhe long-term safe investment banati hain.

Risks:

- Lower Growth Potential: In companies ka growth potential limited hota hai, kyunki yeh market me pehle se establish hoti hain.

- Expensive: Large-cap stocks ka price zyada hota hai, jo high initial investment demand karta hai.

3. Aaj Ke Share Market Ka Analysis

Aaj ke share market me mid-cap aur large-cap stocks ka performance kaafi interesting tha. Mid-cap stocks me kuch outperformers rahe jo market me tezi se upar gaye, jabki large-cap stocks ne relatively stable performance dikhayi.

Mid-Cap Performers:

- Tech Solutions Ltd. ne 8% growth dikhayi aaj ke din, kyunki inka naya product successfully market me launch hua.

- Green Energy Corp. ne bhi 7% ka gain dikhaya, jisse investors ka interest aur badha hai.

Large-Cap Performers:

- Reliance Industries ne 2.5% ka steady growth dikhaya, jo market ke liye stable performance ka sign tha.

- Tata Consultancy Services ne bhi 3% ka rise dikhaya, jo iske stable aur consistent growth ko reflect karta hai.

Data-Driven Insights:

- Aaj ke din me mid-cap stocks ka performance zyada aggressive raha, lekin large-cap stocks ne stability ko maintain kiya.

4. Mid-Cap Stocks ke Advantages

Mid-cap stocks ke kai fayde hain jo unhe long-term investors ke liye attractive banate hain:

- Growth Potential: Mid-cap companies abhi growth phase me hoti hain, jisse unme stock price appreciate karne ka zyada scope hota hai.

- Undervalued Opportunities: Kai mid-cap stocks undervalued hote hain, jisse sahi analysis ke baad low price pe buy karna profitable hota hai.

Recent Mid-Cap Performances:

- Tech Solutions Ltd. aur Green Energy Corp. jaise stocks ne aaj ke din ke top performers ke list me jagah banayi, jo growth potential ko highlight karta hai.

5. Large-Cap Stocks ke Benefits

Large-cap stocks ka stability aur security ka element inhe conservative investors ke liye ideal banata hai:

- Steady Returns: Large-cap stocks stable returns ke liye famous hote hain. Inka long-term outlook consistent hota hai.

- Low Risk: Yeh stocks kaafi stable hote hain, jo volatile market me bhi risk ko kam karte hain.

Recent Large-Cap Performances:

- Reliance Industries aur TCS jaise giants ne aaj ke din steady performance dikhaya, jo in stocks ki stability aur low-risk nature ko reflect karta hai.

6. Aaj Ka Winner: Mid-Cap Ya Large-Cap?

Agar aaj ke market ko dekha jaye, to mid-cap stocks ka performance relatively zyada impressive tha. Aggressive growth aur high returns ki wajah se, mid-cap stocks aaj ke din ke winners rahe. Large-cap stocks, on the other hand, ne stability aur consistency dikhayi, jo unhe long-term investors ke liye ideal banata hai.

Key Factors for Today’s Market:

- Market Sentiment: Investors ka zyada focus high-growth mid-cap stocks par tha, jo overall market me tezi ka reason bana.

- Economic Indicators: Stable economic indicators ne large-cap stocks ko bhi solid performance dikhane me madad ki.

7. Investor Ke Liye Best Strategy

Aapko invest karte waqt apne financial goals ko dhyan me rakhte hue mid-cap aur large-cap stocks ka selection karna chahiye:

- Long-Term Investors: Agar aap long-term investor hain, to large-cap stocks stability aur regular dividends ke liye best hain.

- Risk-Taking Investors: Agar aap zyada risk lene ke liye tayar hain, to mid-cap stocks aapke liye high-growth opportunities offer karte hain.

Future Strategy:

Market conditions ke hisaab se dono stocks categories ka apna importance hai. Diversification ke sath invest karna ek smart strategy hogi.

Conclusion

Aaj ke share market me mid-cap stocks ne strong growth dikhayi, jo aggressive investors ke liye faidemand raha. Large-cap stocks ne stability aur low-risk performance dikhayi, jo conservative investors ke liye ideal rahe. Dono categories ka apna importance hai, aur aapki investment strategy inke pros aur cons ko samajhkar best perform kar sakti hai.

[…] Trading as a Business […]

Hello!

Good cheer to all on this beautiful day!!!!!

Good luck